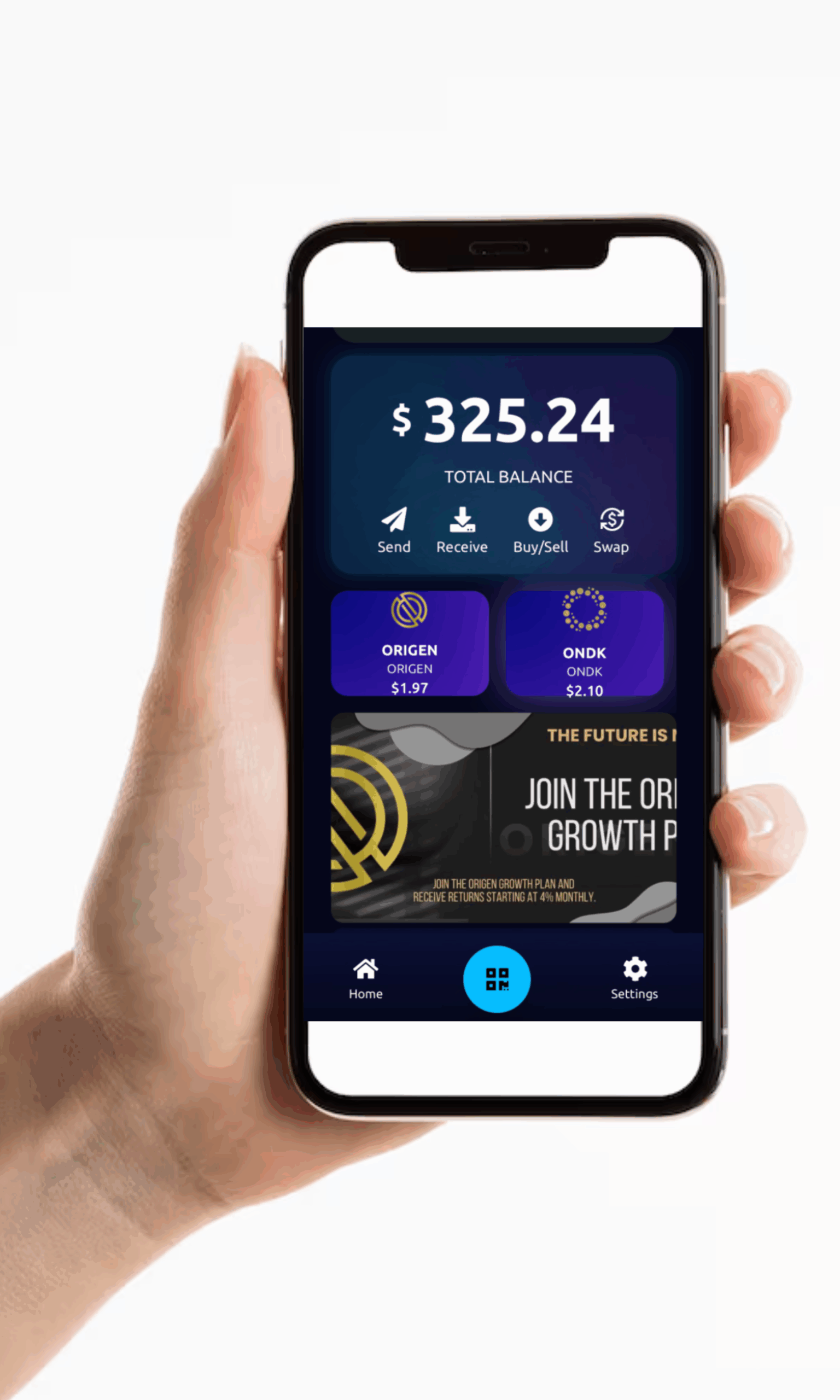

VETA WALLET:

THE NEW GENERATION OF DIGITAL AND CRYPTO BANKING

Veta Wallet represents a true revolution in the way people in Latin America can interact with money. It is a universal wallet, bank account, DeFi platform, and international card—all integrated into a single secure, regulated, and global ecosystem.

Designed by Orden Global, Veta Wallet allows users to save, invest, send money, pay for services, and access decentralized financial products without compromising security, transparency, or the legal backing of a regulated environment.

Thanks to Orden Global’s legal registration in Próspera ZEDE, both the company and Veta Wallet are positioned as pioneers in offering a hybrid banking model (traditional + crypto) with international reach, digital accessibility, and a sustainable vision for the future. This regulatory framework provides unique advantages in taxation, compliance, and global projection, consolidating Veta Wallet as a platform with institutional backing and international credibility.

Main Benefits and Features

Veta Wallet is the ultimate financial platform that integrates both dollars and cryptocurrencies in a single app, offering a complete and modern experience for managing your finances. Designed for convenience, security, and efficiency, it allows you to manage, convert, and transfer your assets instantly, all in a reliable and fully digital environment. With Veta Wallet, controlling your finances, saving, investing, and making global payments has never been faster, safer, simpler, or more accessible from anywhere in the world.

- Single Account for Dollars + Crypto:

Manage both types of assets from one platform, simplifying your financial life.

- Instant Crypto-to-Dollar Conversion:

Convert your funds instantly without complicated processes.

- Instant Virtual Debit Card:

Generate your virtual card from the app in seconds and use it for online purchases, international payments, or digital subscriptions.

Offers biometric authentication, limit controls, security tokenization, and compatibility with platforms like PayPal, Google Pay, and Apple Pay. Ideal for users who want to operate globally without relying on a physical card.

- International Dollar Transfers:

Send or receive money abroad quickly and at low cost.

- Savings Account with Annual Interest (~4%):

Earn competitive returns on your dollar deposits.

- Regulated Security and Custody:

Your funds are protected, with formal verification and oversight.

- 100% Digital Account Opening:

Open your account through the app—no lines, no paperwork, no branch visits.